<p style=" margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;"> Biglari Holdings 2013 Letter To Shareholders

About the author:Canadian Valuehttp://valueinvestorcanada.blogspot.com/

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

BH STOCK PRICE CHART

421.99 (1y: +4%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BH',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1371790800000,404.21],[1372050000000,400.24],[1372136400000,408.63],[1372222800000,408.3],[1372309200000,409.55],[1372395600000,410.4],[1372654800000,412.85],[1372741200000,414.99],[1372827600000,412.42],[1373000400000,415.38],[1373259600000,415.82],[1373346000000,415.63],[1373432400000,414.81],[1373518800000,418.35],[1373605200000,418.7],[1373864400000,423.71],[1373950800000,422.5],[1374037200000,425.16],[1374123600000,433.98],[1374210000000,430.8],[1374469200000,428.72],[1374555600000,425.13],[1374642000000,420.75],[1374728400000,419.33],[1374814800000,419.13],[1375074000000,416.4],[1375160400000,416],[1375246800000,416.56],[1375333200000,421.98],[1375419600000,432.36],[1375678800000,433.97],[1375765200000,428.47],[1375851600000,431.85],[1375938000000,438.7],[1376024400000,441],[1376283600000,438.67],[1376370000000,439.1],[1376456400000,444.77],[1376542800000,442.79],[1376629200000,442.12],[1376888400000,444.5],[1376974800000,449.7],[1377061200000,456.49],[1377147600000,465.99],[1377234000000,431.71],[1377493200000,429.71],[1377579600000,408.6],[1377666000000,413],[1377752400000,418.36],[1377838800000,417.45],[1378184400000,420.31],[1378270800000,420.29],[1378357200000,417.6],[1378443600000,418.13],[1378702800000,418.53],[1378789200000,419.04],[1378875600000,414.05],[1378962000000,414],[1379048400000,417.96],[1379307600000,418.14],[1379394000000,424.49],[1379480400000,425.01],[1379566800000,427.25],[1379653200000,422.51],[1379912400000,422.41],[1379998800000,422.44],[1380085200000,415.12],[1380171600000,419.19],[1380258000000,413.93],[1380517200000,412.67],[1380603600000,414.97],[1380690000000,415.22],[1380776400000,412.05],[1380862800000,413.99],[1381122000000,413.12],[1381208400000,410.62],[1381294800000,410.93],[1381381200000,413.03],[1381467600000,414.26],[1381726800000,415.33],[1381813200000,411.33],[1381899600000,413.05],[1381986000000,414.4],[1382072400000,416.39],[1! 382331600000,416.7],[1382418000000,415.9],[1382504400000,415.64],[1382590800000,419.86],[1382677200000,421.08],[1382936400000,425.57],[1383022800000,431.69],[1383109200000,430.03],[1383195600000,436.02],[1383282000000,437.37],[1383544800000,445.71],[1383631200000,453.21],[1383717600000,454.08],[1383804000000,456.95],[1383890400000,456.46],[1384149600000,455.71],[1384236000000,455.04],[1384322400000,456.74],[1384408800000,456.51],[1384495200000,461.72],[1384754400000,460.25],[1384840800000,460.61],[1384927200000,462.89],[1385013600000,474.58],[1385100000000,478.01],[1385359200000,480.34],[1385445600000,480.79],[1385532000000,483.9],[1385704800000,485.06],[1385964000000,474.87],[1386050400000,481.59],[1386136800000,480.44],[1386223200000,480.59],[1386309600000,490.17],[1386568800000,495.72],[1386655200000,485.34],[1386741600000,479.24],[1386828000000,477.09],[1386914400000,475.31],[1387173600000,483.55],[1387260000000,480.36],[1387346400000,482.68],[1387432800000,488.25],[1387519200000,498.5],[1387778400000,511.06],[1387864800000,519.21],[1388037600000,519.27],[1388124000000,518],[1388383200000,509.95],[1388469600000,506.64],[1388642400000,500.68],[1388728800000,502.17],[1388988000000,485.82],[1389074400000,484.87],[1389160800000,478.7],[1389247200000,476.09],[1389333600000,479.56],[1389592800000,483.21],[1389679200000,491.97],[1389765600000,487.8],[1389852000000,490.02],[1389938400000,486.38],[1390284000000,485.33],[1390370400000,484.51],[1390456800000,474.08],[1390543200000,466.06],[1390802400000,457.35],[1390888800000,445],[1390975200000,441.72],[1391061600000,444.74],[1391148000000,436.96],[1391407200000,425.68],[1391493600000,420.49],[1391580000000,413.62],[1391666400000,419.15],[1391752800000,421.31],[1392012000000,418.04],[1392098400000,429.03],[1392184800000,430.76],[1392271200000,430.28],[1392357600000,430.83],[1392703200000,427.29],[1392789600000,423.01],[1392876000000,429.49],[1392962400000,436.11],[1393221600000,439.77],[1393308000000,440.14],[1393394400000,446.25],[1393480800000,446.04],[1393! 567200000! ,448.99],[1393826400000,445.6],[1

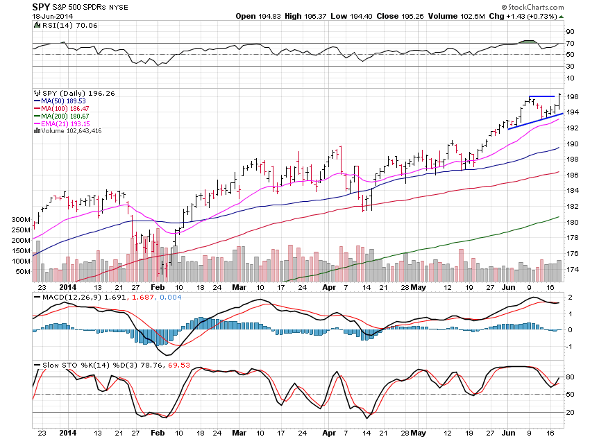

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.